Online payment gateway for tech support-Crisp info care

|

| Best Performing Gateway of India |

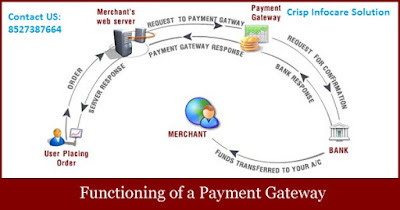

Payment Gateway Process:When a customer orders a product from a payment gateway-enabled merchant, the payment gateway performs a variety of tasks to process the transaction.

1. Customers place order on website by pressing the 'Submit Order' or equivalent button, or perhaps enters their card details using an automatic phone answering service.

2. If the order is via a website, the customer's web browser encrypts the information to be sent between the browser and the merchant's web server. In between other methods, this may be done via (Secure Socket Layer) encryption. The payment gateway may allow transaction data to be sent directly from the customer's browser to the gateway, bypassing the merchant's systems. This reduces the merchant's Payment Card Industry Data Security Standard compliance obligations without redirecting the customer away from the website.

3. The merchant then forwards the transaction details to their payment gateway. This is another encrypted connection to the payment server hosted by the payment gateway.

4. The Integrated Payment Gateway converts the message from XML to ISO-8583 or a variant message format (format understood by EFT Switches) and then forwards the transaction information to the payment processor used by the merchant's acquiring bank.

5. The payment processor forwards the transaction information to the card association (I.e.: Visa/MasterCard/American Express). If an American Express or Discover Card was used, then the card association also acts as the issuing bank and directly provides a response of approved or declined to the payment gateway. Otherwise [e.g.: MasterCard or Visa card was used], the card association routes the transaction to the correct card issuing bank.

6. The bank receives the authorisation request, verifies the credit or debit available and then sends a response back to the processor with a response code i.e. approved, denied. Meanwhile, the credit card issuer holds an authorisation associated with that merchant and consumer for the approved amount.

7. The processor forwards the authorisation response to the payment gateway for tech support.

8. The Best Performing Gateway receives the response, and forwards it on to the website where it is interpreted as a relevant response then relayed back to the merchant and cardholder.

9. The entire process typically takes 2–3 seconds.

10. The merchant then fulfils the order and the above process can be repeated but this time to "Clear" the authorisation by consummating the transaction. This results in the issuing bank 'clearing' the ‘authorisation’ and prepares them to settle with the merchant acquiring bank.

11. The merchant submits all their approved authorisations, in a "batch" to their acquiring bank for settlement via its processor.

12. The acquiring bank makes the batch settlement request of the credit card issuer.

13. The acquiring bank subsequently deposits the total of the approved funds into the merchant's nominated account (the same day or next day). This could be an account with the acquiring bank if the merchant does their banking with the same bank, or an account with another bank.

14. The entire process from Payment Gateway for Tech Support authorisation to settlement to funding typically takes 3 days.

Our Payment Gateway Features:

• Best customer service

• Lowest transaction rate in the industry

• Secure verification

• Online payment

Comments

Post a Comment